We have made donating stocks and other securities as simple as possible by partnering with Overflow. You decide how much to give and when, then Overflow takes care of the rest. CSNTM receives your donation and you enjoy the tax benefits!

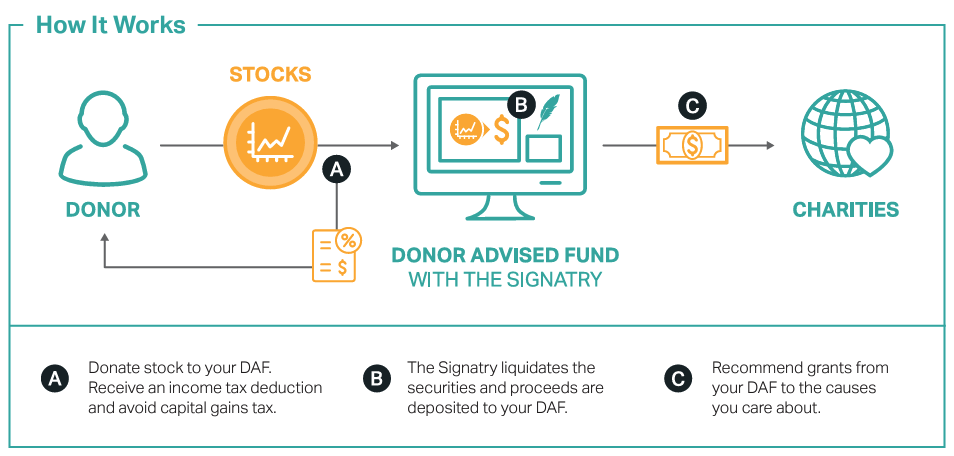

If you want to control the precise timing of your generosity, you can give your publicly traded securities to a donor advised fund (DAF). This avoids capital gains taxes, which maximizes the gift to your favorite charity, including CSNTM. Then, you can determine when to direct the funds.

We partner with The Signatry and other reputable firms that can help you set up and maintain your donor-advised fund (DAF). Overflow can then assist with your DAF donation to CSNTM.

Here is a comparison between this creative approach of donating stocks to your DAF and the traditional approach of selling securities and then giving from the proceeds.

Of course, the same is true when you donate securities directly to CSNTM via Overflow. The added benefit of maintaining a donor-advised fund (DAF) is that you can donate to the fund at any time, and then decide later when (and to whom) you wish to direct the proceeds.